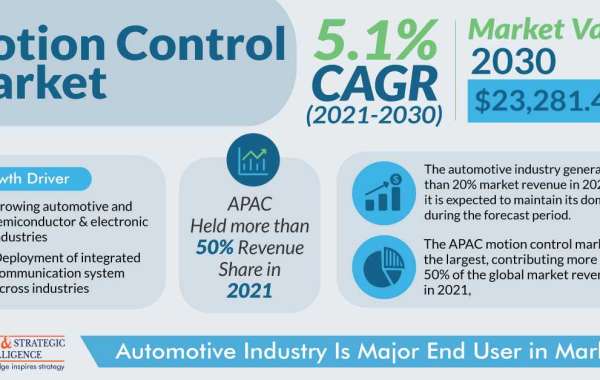

The motion control market generated a revenue of $14,887.5 million in 2021, and it is expected to contribute $23,286.4 million in 2030, progressing at a rate of 5.1% from 2021 to 2030, ascribed to the rising demand for industrial robots and integration of components with the motion control systems for convenient use.

Moreover, the evolving motion control standards and protocols propel the market, for example, the OPC UA TSN protocol controls the entire system, while MQTT is a lightweight protocol relevant to the communication between two applications. MQTT is integrated into a single product and allows a drive or sensor to extract data from a device and send it to the cloud.

Additionally, the advent of digitization in the manufacturing sector, fuelled by the industry 4.0 revolution expands the motion control market. The key contributor to the success of the industry 4.0 initiatives is mechatronics motion control. For example, smart servo technology facilitates inexpensive, high-efficiency, eco-friendly, safe, and compact machinery.

The motor is the crucial component in the motion control systems, and it captures 40% of the market share, due to an increase in the preference of manufacturers toward more energy-efficient motors to further reduce the operational cost and environmental footprint. Moreover, drives are predicted to experience exponential growth in the near future, at approx. rate of 5%, which regulated the speed of the electric motors.

Closed-loop systems dominate the market, attributed to their wide usage across industries, owing to numerous functional benefits of closed-loop systems than open-loop systems that involve no human intervention, due to complete automation.

The automotive industry contributes significant revenue to the motion control market, amounting to 20%, and it is expected to retain its position in the near future, due to massive autonomous driving technologies adoption. Companies are focusing on launching automated driving or self-driving facilitating motion control solutions. For

General variants hold an extensive proportion of the motion control market, and they are projected to experience substantial growth in the near future. The surge in the GMC category is led by the wide GMC servo motors and servo drives application across industries, primarily electronics, semiconductors, and food and beverages. For instance, Nexteer Automotive partnering with Continental Automotive launched a joint venture, CNXMotion, integrated with the Brake-to-Steer technology and steer-by-wire system variants across various SAE levels of driving automation.

The next significant end user of the motion control market is the semiconductor electronics industry, and it is expected to witness a rise in the demand for the solution at the highest growth rate, due to the increase in adoption of the drives, high-tech motors, and motion controllers. The demand is also rising due to the complexities of the electronics and semiconductor manufacturing process, resulting in the increasing acceptance of miniature devices and microelectronics development.

APAC captures the largest share of the motion control market, accounting for 50%, and it is predicted to retain its position in the near future, due to the rising machine tools production and use of customized robots for varying applications. Moreover, the expansion of the manufacturing plants and quality machine development process is predicted to cause market propulsion.

Therefore, the new product launches in the automotive industry to support self-driving or autonomous driving boost the market.